This scheme was put together to help First Home Buyers to get into the market sooner, and with lower cash deposits.

In this blog I will take you through what the details of The First Home Loan scheme, who is eligible for the scheme, How the scheme works and what to do if you don’t qualify.

What is The First Home Loan Deposit Scheme?

Earlier this year, as part of their electoral promise, the Liberal Party released their plans to help First Home Buyers by establishing The First Home Loan Deposit Scheme (FHDS).

Since their election, the Liberal party have begun to prepare for the roll out of the first Home deposit scheme. They have set the release date set at January 1, 2020.

The scheme is aimed to help First Home Buyers who have only saved a 5% deposit and want to get into the property market sooner rather than later.

Until now, should a Frist Home Buyer want to buy a home without the full 20% deposit, they will have a Lenders Mortgage Insurance premium added to their loan. This insurance policy is to protect the bank or lender, should you default on the loan and they loose money, however it is a cost for the borrower added to the loan at settlement.

To find out more on Lenders Mortgage Insurance you can watch this video or read this blog

How does The First Home Loan Deposit Scheme work?

For the First Home Buyers who qualify for The First Home Loan Deposit scheme, they will be able to borrow up to 95% of the purchase price of their First Home, without having to pay the additional Lenders Mortgage Insurance charge… #winning

Rather than have an Insurance policy on the loan to protect the lender, the National Housing Finance and Investment Corporation (NHFIC) will guarantee the loan. In other words, if things go wrong, the Government will ‘spot’ you.

There is a select number of lenders and Banks that will have access to the low deposit schemes, and they include;

- Commonwealth Bank

- National Australia Bank

- Australian Military Bank

- Auswide Bank

- Bank Australia

- Bank First

- Bank of us

- Bendigo Bank

- Beyond Bank Australia

- Community First Credit Union

- CUA

- Defence Bank

- Gateway Bank

- G&C Mutual Bank

- Indigenous Business Australia

- Mortgage port

- MyState Bank

- People’s Choice Credit Union

- Police Bank (including the Border Bank and Bank of Heritage Isle)

- P&N Bank

- QBANK

- Queensland Country Credit Union

- Regional Australia Bank

- Sydney Mutual Bank and Endeavour Mutual Bank (divisions of Australian Mutual Bank Ltd)

- Teachers Mutual Bank Limited (including Firefighters Mutual Bank, Health Professionals Bank, Teachers Mutual Bank and UniBank)

- The Mutual Bank

- WAW Credit Union

Am I eligible for The First Home Loan Deposit Scheme?

First and foremost, it is exclusively for First Home Buyers, and by this I mean, all persons must be a First Home Buyer (i.e If it’s your first home and your partners subsequent, you don’t qualify)

In addition to this, the other criteria include;

- Income no greater than $125,000 per annum for singles and up to $200,000 per annum combined for couples

- Loan purpose must be owner-occupied home

- The loan must be on principal and interest repayments

- Subject to lending criteria eligibility

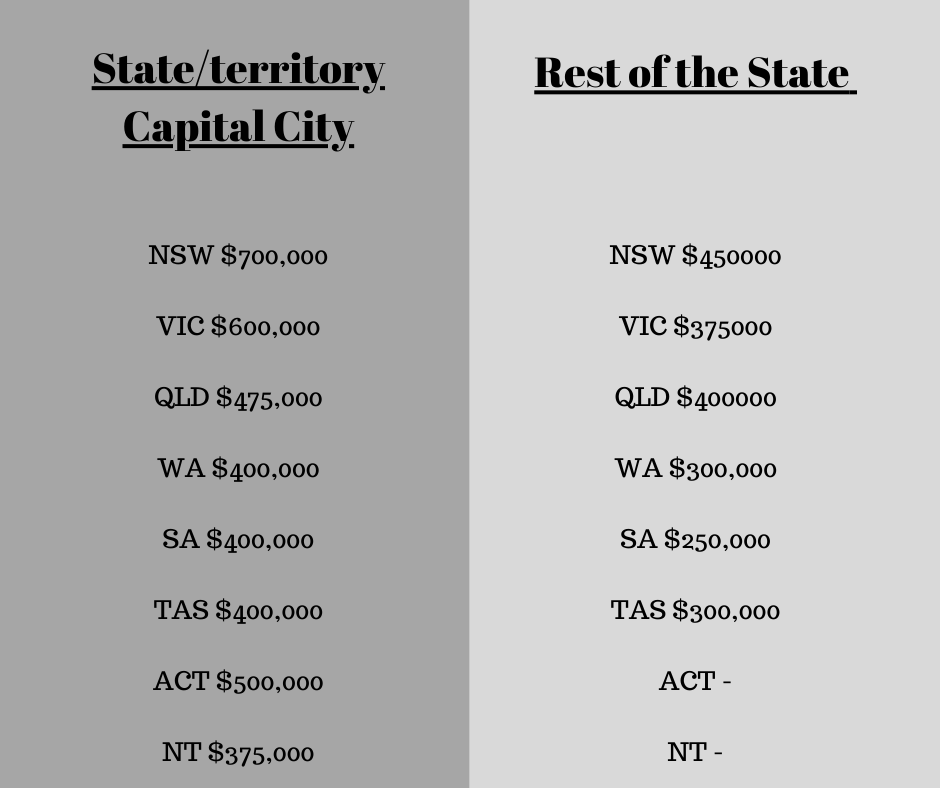

- Purchase price Thresholds (see table below)

You can use the tool on the NHFIC website to check your eligibility

What do I do if I want to apply?

The government has agreed to guarantee a maximum of 10,000 First Home Buyers in 2020, this means, time is of the essence. If you are wanting to take advantage of the scheme, you need to start preparing, yesterday.

Given that January 1st, 2020 is just around the corner I would encourage anyone who wants to apply to consider the following;

- Know your Monthly living expense and why it’s important, you can watch this video to find out more.

- Consider getting a fully assessed pre-approval in place so when the new year hits you are ready to go

- Make sure your application will fit with your selected lender. Because there is a limited number of lenders, with specific policies, making sure you tick all their boxes before sending an application in is a must

What are the Pro’s and Con’s of The First Home Loan Deposit Scheme?

The Pros are obvious, by using The First Home Loan deposit scheme a First Home Buyer can save themselves thousands of dollars in Lenders Mortgage Insurance, and when that is capitalised to the loan (and paid off over 30 years) even more on interest.

Another Pro is that the scheme can be used with the First Home Super Saver Scheme FHSSS so if you’ve been adding savings for your First Home to your Super you can use those funds along with The First Home Loan Deposit Scheme.

The Cons would be a limited number of lenders. If you have managed to save an 8-10% deposit, you can open your lenders up to many more offers and more importantly, many more policies.

Particularly if your application is a little ‘outside the box’ then it can help to have many lenders to choose from rather than a select number.

In addition, another Con would be, once you have your loan guaranteed under the scheme, if you were to refinance the loan to another lender and the value of the loan not be at or below 80% of the value of the home then you will not be able to ‘transfer’ the guarantee to the new lender which would mean you either pay Lenders Mortgage Insurance or stay with the current lender until you are able to move.

Another huge Con is that it is limited to 10,000 First Home Buyers each year so if you miss out, you will either must wait until 2021 or keep building on your savings.

Help, I don’t qualify…

While this is great news, especially for the first 10,000 people who qualify, but, what about those First Home Buyers who don’t qualify?

The good news is there is still help available;

Local Government Grants

Most states have incentives and grants to help First Home Buyers to get into the market. To find out which grant may apply for your state head to First Home Owners Grant page and follow the link to your state.

Stamp duty concessions

As well as Government Grants, depending on the state you are buying in, you could also be eligible for different Stamp Duty concessions. In some cases, the whole stamp duty is waived.

To find out how much stamp duty you do (or don’t) have to pay, do a Calculator here.

The Frist Home Buyers Program

The program is an online program aimed to help First Home Buyers to save their 10% deposit. The program will also educate you around how to buy your first home from loan structure to house hunting and beyond.

Regardless if you qualify for The First Home Loan Deposit Scheme, I would encourage you to check out The First Home Buyers Program here.

Family Guarantee

Rather than having the Government guarantee your loan, you could have a family member , guarantee your loan, in some cases this will allow you to borrow the full purchase cost and save you Lenders Mortgage Insurance as well. To find out more, read the blog

In summary, The First Home Loan Deposit Scheme will be fantastic for a select number of First Home Buyers but the key is, if you are serious about getting into your First Home, I suggest you book a FREE First Home Buyer Strategy call here so you can discuss the options available to you, in your unique situation.

Not ready to talk to an expert?

The First Home Buyers Program is the perfect place to start your First Home Buying Journey. The online, self-paced modules are designed to take you through everything you need to know from how much deposit do you need, to how to budget and what experts you need when buying a home.

You can check out the modules and course outline here.