Have you ever seen an advertisement similar to this…

I know I see them all the time at this time of year, or heading into the End of Financial Year.

When I first took notice of the discounted interest rates offered by car yards I thought ‘there has to be a catch!’

Surely they are charging more in fees in lieu of interest, or doing something else behind the scenes to cover that cost, after all, they are running a profitable business.

This lead me to research what the truth was, and how they can offer this low (and at times no interest) finance.

I wanted to know because I was working for a Major Bank who couldn’t compete with the car yard offerings and also, (if I’m honest, mainly) because I was in the market for a new car and I wanted to get the best deal I could, and here’s what I found…

We all know the drill when you are looking for a new car (or motor bike, jet ski, boat ect) you talk to the attendant, pick the right make and model that suits your needs and then send your ‘negotiator’ (unless you’re lucky enough to have this skill yourself) in to get the best price you possibly can.

What you will generally find is, if there is finance to be taken on the item, and the finance is through the car yard (using their discounted, or no interest offer) the negotiation is quite limited if at all. This means you are forced to pay the retail price of the car rather than being able to negotiate the cost down.

What can you do to find out which is the best option for you?

Simple, when you are Car shopping, do some quick calculations to work out which option will be the cheapest for you.

For example, lets say I am looking at a car priced at $25k.

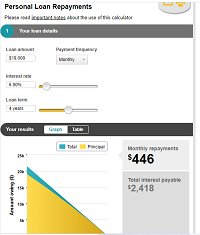

I have done a calculator for a personal loan with the following details; a Car loan at 6% interest, over a 4 year loan term and a purchase price of $19k would be approximately $2418 over the life of the loan.

In this example the total cost of the car, after I add allowance for other fees in would be approximately $22k.

Lets say this particular car had a retail price of $25k which the car yard were able to discount to $24K though their in house financing at 0%

In the above scenario your best option would be to get your finance elsewhere, negotiate the price right down and, if you can, make extra repayments on the personal loan to save yourself some of that $2418 interest. (this will depend on the loan type and your finances available)

The key is, next time you are considering a new car (or Toy) do the sums before you commit to a loan no matter what the interest rate so you know you are getting the best deal for you.

If you want to know more, or you want some help to do the sums before your next purchase just phone me on 0412 862 811 or email me at maryanne@360mortgagesolutions.com.au