Owning your own home was once the ‘Aussie Dream’ but these days it can seem easier to rent. Especially if, you are already in the ‘rent cycle’ then getting your deposit saved to get your foot in the property market can be a challenge.

Having said that, there has never been a better time to get into the market, Here’s why you need to consider buying your First Home now rather than later…

Future Equity:

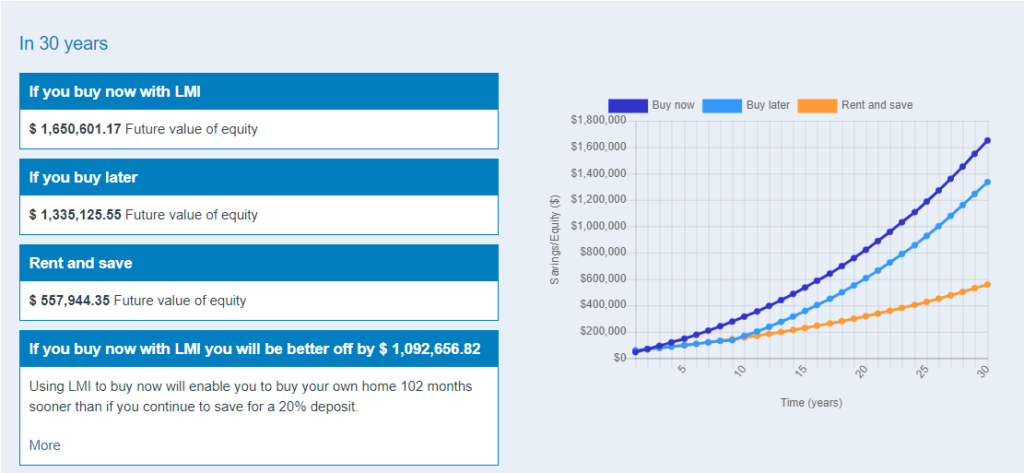

Getting into the marker sooner, with the help of a Family Guarantee or Lenders Mortgage Insurance will mean you are putting your money towards an asset that, typically increases in value over time. I love hearing about how much my parents spent on their first home and how they thought it was so much money… and to think what that little 3 bedroom home in Melbourne would be worth in today’s market is mind blowing.

There’s a great calculator here where you can do some comparisons for yourself to see what you would save if you purchased now rather than waiting to save your deposit.

Interest Rates

Interest rates are at an all time low! It seems for the last 4 years I have been saying, ‘they can’t get much lower’ and ‘rates will go up at some point’ but the reality is, they are the lowest they have been and certainly taking advantage of the low rates, especially for your First Home is a great idea.

You can do this by locking in a Fixed rate for a period if time which gives you the peace of mind that whilst you’re settling into your new home the interest rate will remain for a set period of time regardless of what the market is doing.

Owning your home

The Aussie dream is to ‘own your home’ not to own a portion while the Bank owns the rest. So the sooner you get into your home and start paying it off, the sooner you can start to pay down your loan and be closer to owning your home outright.

If you would like some more information on buying your home or would like to chat to me please feel free to call me on 0412862811 or book an appointment with me here (appointments can be face to face or via video conference)