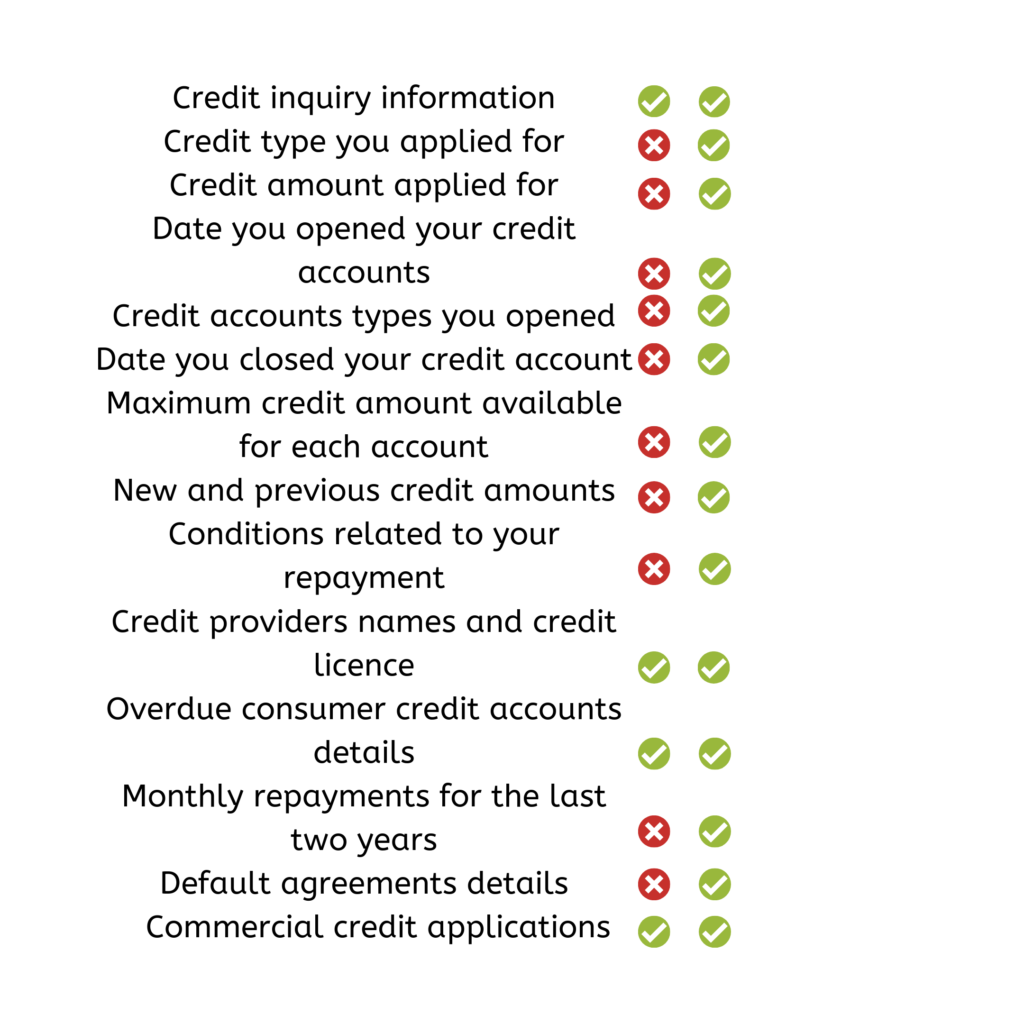

Your credit file contains vital information for anyone looking to loan you money or, when it comes to mobile phones, offer you a long term contract. Early last year, a credit file would consist of all credit inquiries and any defaults you may have had against you as a result of failure to pay.

However, as at July 2018 all that changed, when the Government mandated Comprehensive Credit reporting.

Comprehensive Credit Reporting is where banks a legally obligated to report on your credit file on all aspects of your current credit, this means Credit inquiries, Limits on loans, Overdue or late payments (over the past 2 years) ect.

What this means for you, firstly it means if you are paying all your debts on time every time, then you may be rewarded in the future. As more and more banks upload their information banks and lenders will start to see who the ‘best clients’ are and in the future they may offer additional discounts to persuade these clients to refinance with them.

On the reverse, it means if you are looking to get into your First home in the future, you need to be mindful of your credit score, ensure you are making payments on time and limit the credit inquiries you make. An outstanding credit score when applying for your First Home will give the lender some peace of mind around your character to repay existing debts, and lets be honest, if we were to lend a quarter of a million dollars (in most cases more) to someone, we would want to know everything we could about how they conduct themselves with their current loans.